Accessibility in email marketing

1. July 2024

Market Shares of the Email Service Providers used by the 1,000 Top-Selling German Online Shops:

October 23, 2024

Market shares of e-mail service providers, gains and losses

The 1,000 online shops with the highest revenue in Germany rely on continuity in email marketing – and at the same time on change. This is the seemingly contradictory result of the annual study of the most frequently used email service providers, which we conducted for the seventh time in a row on behalf of the EHI Retail Institute and ecommerceDB. („E-Commerce-Markt Deutschland 2024“).

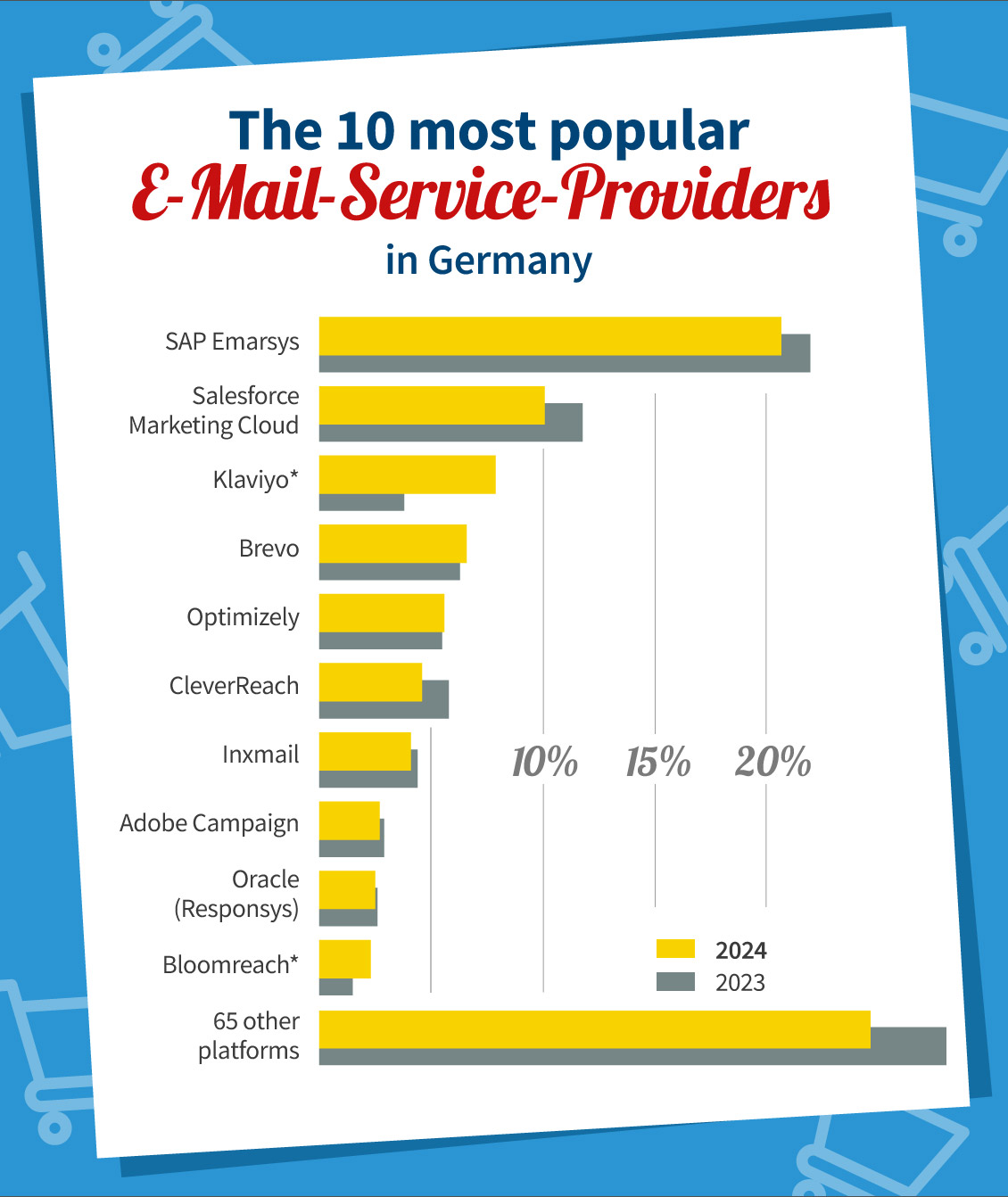

As in previous years, SAP Emarsys and Salesforce Marketing Cloud are the most widely used e-mail marketing platforms. Both continue to cover around a third of the market analysed, albeit with a slight downward trend (30.8% compared to 33.8% in 2023). Klaviyo is continuing its global advance in the German market and has more than doubled its market share to 7.9% within a year (2023: 3.4%). This means that the US company, which is now listed on the stock exchange, is overtaking the established ‘self-service’ platforms CleverReach and Brevo (formerly Sendinblue & Newsletter2Go). Bloomreach is new in the top 10 most-used platforms.

Find out more about our methodology and population

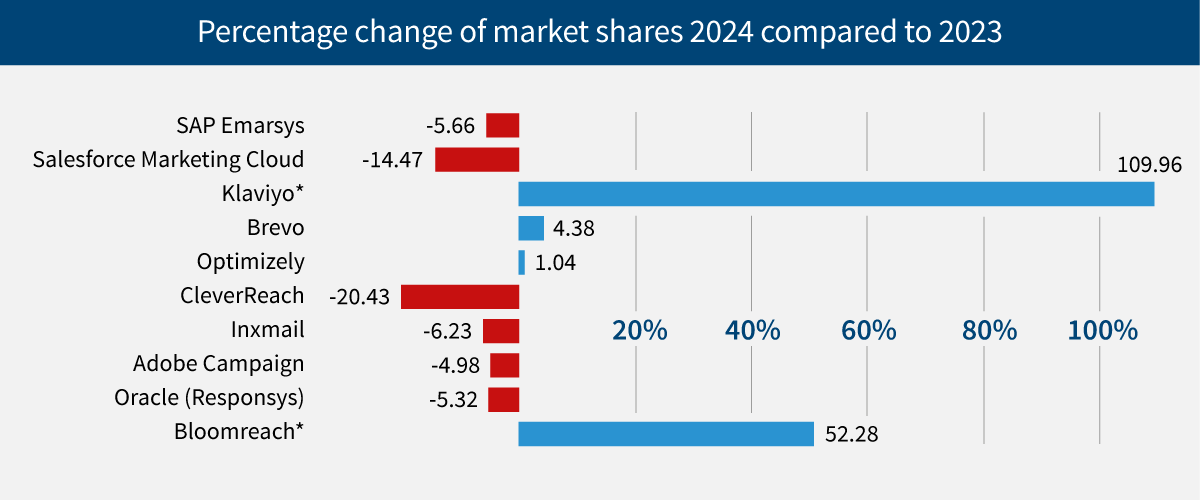

Looking at the gains and losses, it can be seen that Bloomreach and Klaviyo have made the largest proportional gains, while CleverReach has suffered the largest loss of market share in the top 10. Mailchimp, which was once widely used, is now only used by 2.2% of top-selling e-commerce companies and is no longer represented in the top 10.

Market segmentation: different preferences depending on company size

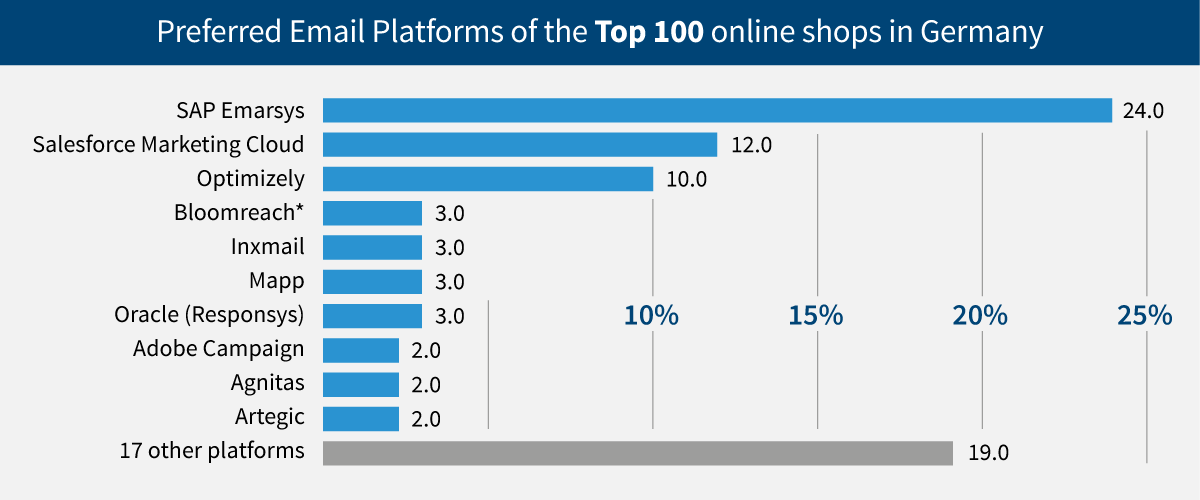

As expected, SAP Emarsys and Salesforce Marketing Cloud dominate among the top 100 shops in Germany. Optimizely (formerly Optivo Broadmail/Episerver) is in third place and Bloomreach is used just as frequently in this group as Inxmail, Mapp and Oracle. The self-service platforms Klaviyo, Brevo or CleverReach are not among the top 100 platforms with the highest revenue.

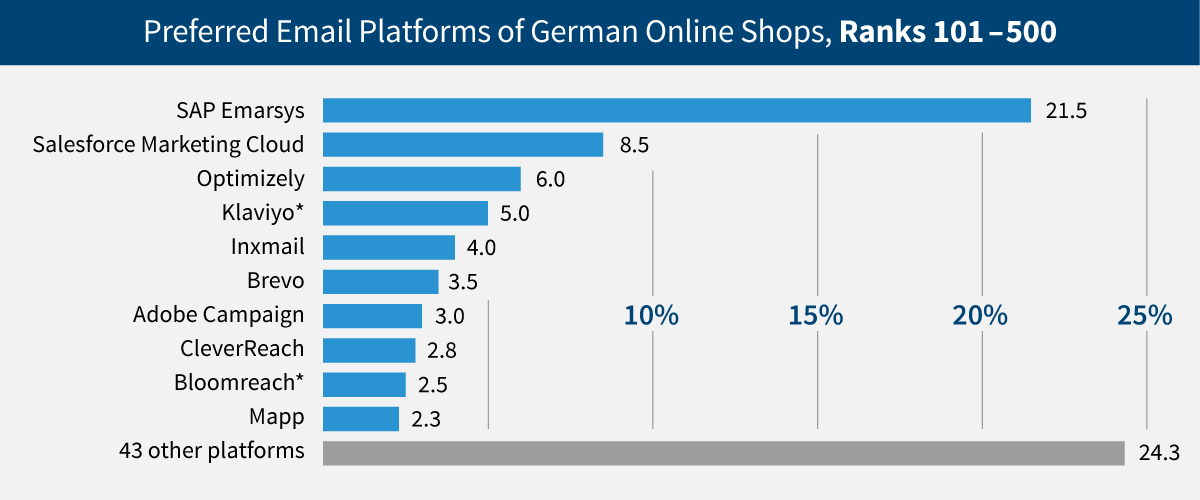

A different picture emerges when looking at shops in the mid-range tier (EHI E-Commerce Rank 101 – 500) with an e-commerce net goods turnover of 19 million to 116 million euros per year). In this tier, SAP Emarsys is 2.5 times more frequently represented than Salesforce Marketing Cloud (in the top 100, it is ‘only’ twice as frequently represented); Klaviyo, Brevo and CleverReach make it into the top 10 in this segment.

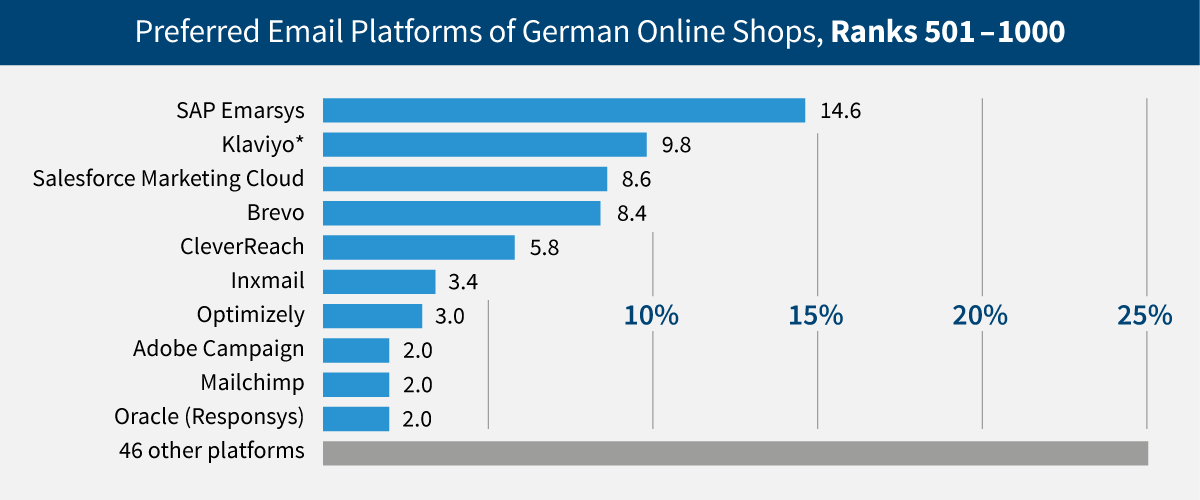

SAP Emarsys also tops the list in the lower half of the top 1,000 – however, only 15 per cent of shops can afford this omnichannel marketing platform. Klaviyo comes in second here, well ahead of Salesforce Marketing Cloud. This revenue segment shows the greatest variety of e-mail marketing platforms in use and, at 15%, also the highest number of online shops that have not sent us a single marketing e-mail in the last 12 months. This analysis clearly shows that the market segments under consideration have different solution preferences – revenues in the 501 to 1000 range rarely allow (or require?) investment in a multichannel marketing automation platform; the focus is on more affordable pricing.

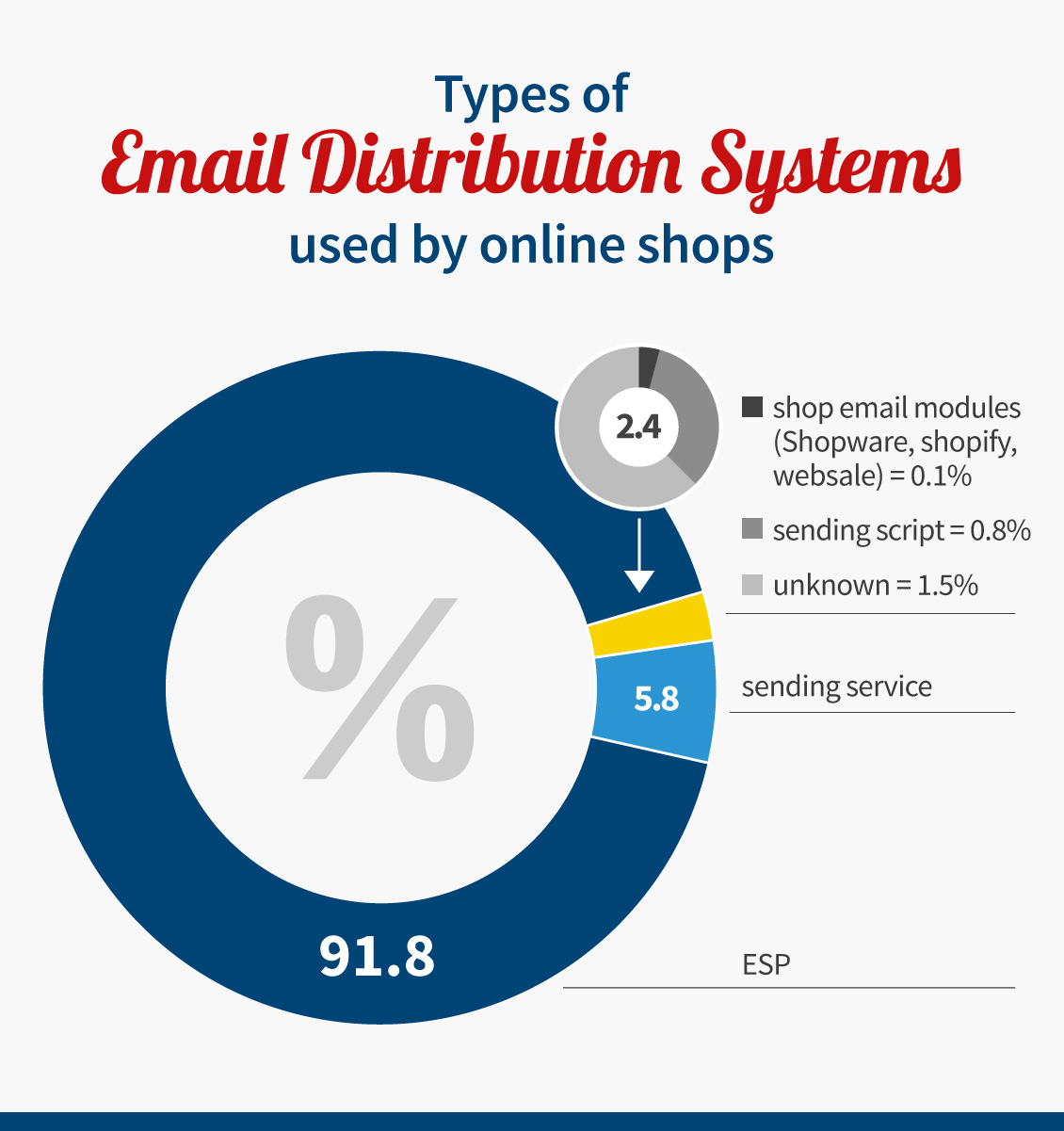

Our analysis also shows that despite the growth of digital channels, e-mail remains an integral part of the e-commerce marketing mix: 88.2% of all the shops analysed send marketing e-mails, and only 4.4% do not offer newsletter registration. Almost all shops use an e-mail service provider (ESP) for their e-mail marketing, namely 91.8% of the 882 shops that sent us at least one marketing e-mail during the 12-month study period.

Last year, we asked at this point: ‘Where is the innovation?’ However, the hoped-for consolidation is still a long time coming and the e-mail and multichannel platform market remains highly fragmented. In addition to the 10 most popular platforms, the online shops with the highest sales use further 65 platforms with a combined market share of 24.7%. The two long-standing market leaders, SAP Emarsys and Salesforce Marketing Cloud, maintain their top positions. Only time will tell whether the decline in their market share indicates that these platforms have passed their peak after almost a quarter of a century on the market.

Meanwhile, younger competitors are gaining in importance: Klaviyo, with a strong e-commerce focus, and Bloomreach, with an integrated customer data platform (CDP), now play a significantly greater role for the top 1000 e-commerce companies than they did one or two years ago.

The development on the German market shows some parallels to the development on the American market. Read on to find out what the e-mail marketing platform trends in North America look like.

Challenges of migrating to a new platform: Never change a running system

Changing marketing platforms involves significant costs and risks. Our long-term analyses show a remarkable loyalty of digital marketing managers to their e-mail platforms:

- 44% of the shops that have been among the top 1,000 online shops in Germany since we began our studies have not changed their platform in the last seven years.

- 40% of the shops only changed their e-mail platform once during this period.

- Only 15% of the shops changed their marketing platform every two to three years.

Individual paths to success: e-mail marketing in diversified e-commerce

In the e-commerce market, two main groups are emerging regarding e-mail marketing: benefit maximisers, who want to exploit the full potential of their customer base with powerful tools, and cost minimisers, who want to generate e-mail-driven revenue with minimal effort. This classification correlates with company size, but does not allow for a clear-cut assignment. The largest e-retailers tend to include fewer cost minimisers, but all platform solution classes are represented in all market segments, if to varying degrees.

The choice of the optimal e-mail marketing technology is not determined by company size, range of functions or industry focus alone. Rather, the strategic direction and the available marketing resources play a decisive role. Each online shop develops its own strategies to be successful in the intensely competitive digital arena.

The market shares of the 75 e-mail service providers among the EHI Top 1.000 e-commerce companies in Germanya

| E-mail service provider | Market share 2024 | Market share 2023 | 2022 in % | 2021 in % | 2020 in % | 2019 in % | 2018 in % |

| SAP Emarsys | 20.7% | 22.0% | 21.5 | 22 | 22.8 | 23.3 | 21.9 |

| Salesforce Marketing Cloud | 10.1% | 11.8% | 10.6 | 11.1 | 10.5 | 8.2 | 5.3 |

| Klaviyo | 7.9% | 3.8% | 3.1 | 1.9 | 0.8 | 0.5 | 0.3 |

| Brevo (Sendinblue + Newsletter2Go) | 6.6% | 6.3% | 5.4 | 4 | 4.1 | 3.2 | 3.6 |

| Optimizely (Episerver/Optivo) | 5.6% | 5.5% | 6.7 | 7.7 | 9.8 | 11 | 12.2 |

| CleverReach | 4.6% | 5.8% | 6.4 | 5.8 | 7 | 7.6 | 7 |

| Inxmail | 4.1% | 4.4% | 5.1 | 6.3 | 7.1 | 7.5 | 6.8 |

| Adobe | 2.7% | 2.9% | 3 | 3.5 | 3.4 | 3 | 3 |

| Oracle (Responsys) | 2.5% | 2.6% | 2.8 | 2.9 | 2.5 | 2.5 | 2.9 |

| Bloomreach (Exponea) | 2.3% | 1.5% | 1.2 | 0.8 | 0.6 | n/a | n/a |

| Mailchimp | 2.2% | 3.4% | 3.4 | 4.8 | 6.1 | 6.4 | 6.6 |

| Rapidmail | 1.6% | 2.2% | 2 | 2 | 1.6 | 1.8 | 1.2 |

| Mapp | 1.6% | 1.8% | 2.1 | 2.8 | 2.8 | 3.7 | 5.1 |

| Selligent | 1.4% | 1.7% | 1.8 | 1.4 | 1.3 | 1.7 | 1.6 |

| Xqueue | 1.4% | 1.3% | 1.3 | 1.8 | 1.9 | 1.7 | 1.6 |

| Voyado | 1.1% | 0.5% | 0.2 | n/a | n/a | n/a | n/a |

| GetResponse | 0.9% | 1.6% | 1.3 | 1.3 | 0.5 | n/a | 0.1 |

| Agnitas | 0.9% | 1.1% | 1.2 | 1.2 | 1.1 | 1.3 | 1.6 |

| SAP Marketing Cloud | 0.9% | 0.9% | 0.5 | 0.7 | 0.6 | 0.3 | n/a |

| Braze* | 0.8% | 0.6% | 0.6 | 0.2 | n/a | n/a | n/a |

| Other e-mail service providers | Market share 2024 |

| Artegic | 0.7% |

| Active Campaign | 0.7% |

| Microsoft Dynamics 365 | 0.6% |

| Hubspot | 0.5% |

| Marigold Engage+ (Cheetah Digital) | 0.5% |

| Iterable* | 0.5% |

| Mailingwork | 0.5% |

| mission‹one› | 0.5% |

| Retarus | 0.3% |

| Deploytech (Clang) | 0.3% |

| Sailthru | 0.3% |

| SALESmanago | 0.3% |

| AIC CCS | 0.2% |

| Bluecore* | 0.2% |

| Copernica | 0.2% |

| Customer.io* | 0.2% |

| dotmailer | 0.2% |

| drumedar | 0.2% |

| EmailLabs | 0.2% |

| Insider | 0.2% |

| JUNE | 0.2% |

| Klick-Tipp | 0.2% |

| Marketo | 0.2% |

| Optimizely | 0.2% |

| Optimove | 0.2% |

| Oracle (Eloqua) | 0.2% |

| Splio SPRING | 0.1% |

| Acoustic Campaign | 0.1% |

| Atrivio | 0.1% |

| Campaign.Plus | 0.1% |

| Compost Carma | 0.1% |

| Consultix ProCampaign | 0.1% |

| ContactLab | 0.1% |

| Cordial* | 0.1% |

| Custobar | 0.1% |

| e-vendo Smartmail | 0.1% |

| ExpertSender | 0.1% |

| Interspire* | 0.1% |

| Listrak | 0.1% |

| MagNews | 0.1% |

| Mailkit | 0.1% |

| MailPoet | 0.1% |

| Mailworx | 0.1% |

| MoEngage* | 0.1% |

| Netcore Cloud | 0.1% |

| Ometra* | 0.1% |

| promio.net | 0.1% |

| RedEye | 0.1% |

| SC Networks (Evalanche) | 0.1% |

| sendeffect | 0.1% |

| Sendy | 0.1% |

| Spotler | 0.1% |

| Ubivox | 0.1% |

| Wayfair in-house platform | 0.1% |

| Wilken E-Marketing Suite | 0.1% |

| Other e-mail distribution systems |

Market share 2024 |

| Sendingservice: Amazon SES ** | 1.6% |

| Sendingservice: Mailjet ** | 1.4% |

| Sendingservice: Sendgrid ** | 1.2% |

| Sendingservice: SparkPost ** | 1.0% |

| Sendingservice: Mailgun ** | 0.3% |

| Sendingservice: Brevo (SMTP Relay) ** | 0.2% |

| Shop: Websale | 0.1% |

| SendingScript | 0,8% |

| Sender not detected | 1.5% |

Regarding the methodology

Basis: Analysis of the 1,000 B2C online shops with the highest revenue and the top 10 B2C marketplaces in 2024, as determined by the EHI Retail Institute and ecommerceDB: ‘Study: E-Commerce Market in Germany 2024’, sorted by e-commerce revenue in the 2023 financial year.

a Online shops that sent commercial e-mails via a solution identified as an ESP, sending service or web shop e-mail module during the 12-month study period. The percentage market share is calculated based on the number of companies for which the respective sender was identifiable. n = 882

Identified front-end tool – use of a mailing service at the back end.

Market share in per cent minus the percentage of e-commerce companies for which we were able to identify a front-end marketing automation platform that sends mailings. If we were able to identify the front-end solution, the market share was attributed to that solution.